Price Index

Meaning and Definitions of Price Index

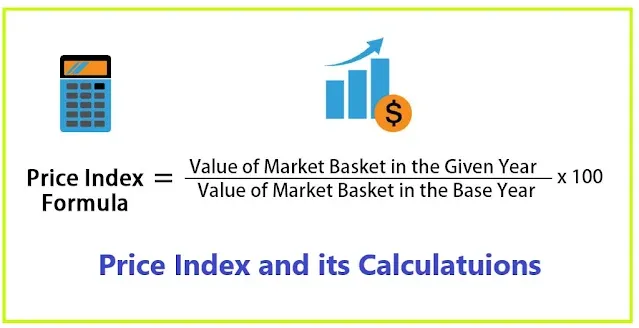

A price index is used to measure the relative changes in price levels. It is a special type of average. A price index is constructed based on the prices of goods or services. It represents the prices of a group of commodities together.

It measures the average change in the prices of representative commodities between two points in time. It is also used to measure changes in the value of money (purchasing power of money).

The price of commodities used in constructing a price index can be wholesale price/producer's price or retail price/consumer's price.

An index constructed based on wholesale prices is called a wholesale price index. It is also known as a producer price index.

Similarly, a price index constructed based on retail prices is called a retail price index or consumer price index or cost of living index.

According to Irving Fisher, an index number is “a number which measures the relative changes in some quantity or quality over time, or in different places, compared with a fixed standard.”According to Prof. Bowley, “an index number is a simple arithmetical device for comparing the value of a group of related variables at different times or places.”

Features of Price Index

- Measuring Price Level: The price index measures the relative change in the price level across different time periods or locations. It shows whether prices have increased or decreased and by how much they have changed.

- Average Price Change: The price index represents the average price change of a group of goods and services. It helps to observe the overall trend despite fluctuations in the prices of individual items.

- Based on a Base Year: When constructing a price index, a base year is taken as a reference. The price of the current year is compared with the price of the base year to calculate the index.

- Representation of Goods: The price index is based on the prices of representative goods and services within a specific group. Instead of taking the prices of all goods, only those that represent the market condition are selected.

- Use of Weights: In a weighted price index, different goods are assigned weights according to their relative importance. Weights are determined based on factors such as the quantity of consumption, production, or sales.

- Economic Indicator: The price index is considered an important economic indicator. It shows the state of inflation or deflation occurring in the economy.

Steps in Constructing a Price Index

The steps in constructing a price index are presented below:

(a) Determining the Objective

In the first step of constructing a price index, the objective of constructing it should be clear. The type of price index to be constructed depends on its objective.

(b) Selecting the Base Year

In the second step of constructing a price index, the base year is selected. The year based on which changes in prices in other years are compared is called the base year. It is also called the reference year and is denoted by the subscript zero (0).

The year for which the price index is constructed is called the current year. It is denoted by the subscript one (1). The base year selected for the price index should be a normal year.

(c) Selecting Commodities

Representative commodities are selected for constructing the price index. The selection of commodities depends on the objective and type of price index being constructed. Only representative commodities are selected.

(d) Collecting Prices

It should be determined whether the prices to be collected for constructing the price index are wholesale prices or retail prices, and such prices should represent the market. The sources of price collection should be unbiased and reliable.

(e) Selecting the Average

It should be confirmed whether to use the arithmetic mean or other measures of average to construct the price index.

(f) Selecting Weights

All the commodities selected for constructing the price index are not of equal importance. Therefore, appropriate weights should be given to the various commodities in the group based on their relative importance. Different commodities are given appropriate weights based on their quantity of use, purchase, or consumption.

(g) Selecting the Method

There are various methods for constructing a price index. The method to be selected should be confirmed, and the price index should be constructed based on that method. Simple and weighted price indices can be calculated using the aggregate method and the average of price relatives method.

The steps in constructing a price index presented above are also called the difficulties in constructing a price index.

Symbols Used in Price Index

Some of the symbols used in constructing a price index are as follows:

- P₀: Price of commodities in the base year

- P₁: Price of commodities in the current year

- Q₀: Quantity of commodities consumed or purchased in the base year

- Q₁: Quantity of commodities consumed or purchased in the current year

- P₀₁: Price index of the current year based on the base year

- P₁₀: Price index of the base year based on the current year

- W: Weight given to the commodities in the group based on their relative importance

Methods of Constructing Price Index

In a broad sense, price indices can be divided into two types: simple or unweighted and weighted. Both types of price indices and the methods for constructing these indices are presented below:

(a) Simple or Unweighted Price Index

If the various commodities or items selected for constructing the price index are given equal importance or weight, such a price index is called a simple or unweighted price index. It can be constructed using the simple aggregate method and the simple average of price relatives method, which are discussed below.

i) Simple Aggregate Method:

Using this method, the price index is constructed by dividing the sum of the prices of the current year by the sum of the prices of the base year and multiplying the quotient by 100. The price index constructed using the simple aggregate method is called the simple aggregate price index.

Steps for Constructing Simple Aggregate Price Index:

-

Find the sum of the prices of the current year (ΣP₁).

-

Find the sum of the prices of the base year (ΣP₀).

-

To find the simple aggregate price index (P₀₁), divide ΣP₁ by ΣP₀ and multiply by 100, i.e., use the following formula:

P₀₁ = (ΣP₁ / ΣP₀) × 100Where,

ii) Simple Average of Price Relatives Method:

In this method, first, the price relative of all commodities used in the price index is calculated, i.e., the price of the current year is expressed as a percentage of the price of the base year. Then, the average of the price relatives is calculated.

Generally, the arithmetic mean is used for the average. Here, all commodities are given equal weight, even if the price of commodities and the units of measurement of commodities are different.

The price index constructed using the simple average of price relatives method is called the simple average of price relatives index. The steps for constructing the simple average of price relatives index are as follows:

-

Calculate the price relative (P) by expressing the price of the current year as a percentage of the price of the base year, i.e., P = (P₁ / P₀) × 100.

-

Find the sum of the price relatives (ΣP).

-

Divide the sum of the price relatives (ΣP) by the number of commodities in the group (n), i.e., use the following formula:

P₀₁ = (ΣP / n) = (Σ(P₁ / P₀) × 100) / nWhere,

(b) Weighted Price Index

To calculate the weighted price index, the various commodities in the group are given appropriate weights based on their relative importance. Weights can be the number of units produced, the number of units consumed, or the number of units distributed.

For constructing a price index, quantitative weights such as the quantity of commodities consumed, purchased, or sold are used.

If the weight assigned to a commodity is W, then the weighted index can be presented as follows:

P₀₁ = (ΣWP₁) / (ΣWP₀) × 100

There are two methods for constructing the weighted price index: the aggregate method and the average of price relatives method. Here, only the aggregate method is discussed. The aggregate method for constructing the weighted price index is called the weighted aggregate method.

The price index constructed using this method is called the weighted aggregate price index. A large number of formulas have been invented to construct the price index using this method.

The difference between these formulas is the difference in the weights given to the various commodities. Here, only Laspeyres' method and Paasche's method under the weighted aggregate method of calculating the price index are discussed.

(i) Laspeyres' Price Index or Base Year Method: In this method, the quantity of the base year is used as the weight, i.e., W = Q₀ is used in the formula above. The formula for calculating Laspeyres' price index is as follows:

L_P₀₁ = (ΣP₁Q₀) / (ΣP₀Q₀) × 100

(ii) Paasche's Price Index or Current Year Method: In this method, the quantity of the current year is used as the weight, i.e., W = Q₁ is used in the formula above. The formula for calculating Paasche's price index is as follows:

P_P₀₁ = (ΣP₁Q₁) / (ΣP₀Q₁) × 100

Importance or Use and Limitations of Price Index

A price index is used to compare the price level of different time periods or the price level of the same time period in different places. A price index can be taken as a barometer of economic activity. A price index is useful for studying the general trend of prices and for price forecasting.

With the help of a price index, the purchasing power of money or the value of money can be measured. A price index is also helpful in calculating the real wage rate.

To calculate the real wage, the nominal wage is divided by the relevant price index, and the quotient is multiplied by 100.

A price index is used to calculate the net national product or income measured at current prices in terms of base year or constant prices.

The net national product or income calculated at base year or constant prices indicates the net national product or income calculated at constant prices in the context of inflation.

Based on the index constructed on the basis of the base year or constant prices, we can also determine the real wage or income. The government uses price indices to adjust wage policy, price policy, rent control policy, tax policy.

Many other economic policies, such as the volume of trade, wholesale prices, and retail prices, are guided by price indices.

However, the price index is not free from limitations or exceptions. The calculation of the price index is based on the selection of commodity and price samples.

All the errors that occur during the sample selection process affect the construction of the price index. The selection of the formula becomes a problem during the construction of the price index. This can lead to bias.

The rapid changes in the quality, taste, and appearance of commodities make it difficult to make accurate adjustments in the construction of the price index. As a result, the price index may not be an accurate measure of price changes.

The problem of which average to use for the price index arises. Similarly, if the data related to price, consumption, production, etc., collected for the construction of the price index is not accurate, the result of the index may be wrong.

Similarly, if a price index constructed for the purpose of achieving one objective is used for another objective, the conclusions drawn from it may be wrong.

Importance or Use of Price Index:

- Used to compare the price level of different time periods.

- Used to compare the price level of the same time period in different places.

- Can be taken as a barometer of economic activity.

- Useful for studying the general trend of prices.

- Useful for price forecasting.

- Helps to measure the purchasing power of money or the value of money.

- Helpful in calculating the real wage rate.

- Used to calculate the net national product or income measured at current prices in terms of base year or constant prices.

- Helps to understand the net national product or income calculated at constant prices in the context of inflation.

- Can be used to determine the real wage or income based on the index constructed on the basis of base year or constant prices.

- Used by the government to adjust wage policy.

- Used by the government to adjust price policy.

- Used by the government to adjust rent control policy.

- Used by the government to adjust tax policy.

- Guides many other economic policies, such as the volume of trade.

- Guides wholesale prices.

- Guides retail prices.

Limitations of Price Index:

- Calculation is based on the selection of commodity and price samples.

- Errors during the sample selection process affect the construction of the price index.

- The selection of the formula becomes a problem during construction.

- The selection of the formula can lead to bias.

- Rapid changes in the quality of commodities make accurate adjustments difficult.

- Rapid changes in the taste of commodities make accurate adjustments difficult.

- Rapid changes in the appearance of commodities make accurate adjustments difficult.

- May not be an accurate measure of price changes due to the difficulties in adjusting for quality, taste, and appearance changes.

- The problem of which average to use for the price index arises.

- If the data collected (related to price, consumption, production, etc.) is not accurate, the result of the index may be wrong.

- If a price index constructed for one objective is used for another objective, the conclusions drawn from it may be wrong.

.jpeg)

The Economic Frontline is a dynamic, authoritative platform featuring real-time financial updates, expert economic analysis, and in-depth market insights in a sleek, user-friendly structure.

The Economic Frontline is a dynamic, authoritative platform featuring real-time financial updates, expert economic analysis, and in-depth market insights in a sleek, user-friendly structure.